SOME THINGS TO KNOW ABOUT MANAGEMENT OF

ONE MEMBER LIMITED LIABILITY COMPANY

Law on Enterprises 2014 was passed by the National Assembly on 26 November 2014 and will officially take full effect as from 01 July 2015 (“LOE 2014”). This LOE 2014 has created significant changes on regulations and had continuously a vital role of forming favorable business environment for enterprises in Viet Nam.

In this connection, there are some important changes of LOE 2014, such as: simplification of license requirements; more than one legal representative permitted; lower quorum and voting thresholds in LLC and JSC; new reporting duties regarding change of managers; fewer restrictions on founding shareholders in JSC; etc.

Hence, QNT Law Firm would like to issue this Legal Update in order to assist the clients in catching some legislative changes under LOE 2014 relating to management of one member limited liability company (“One Member LLC”).

1. Rights and obligations of the Company Owner

Firstly, the definition of One Member LLC under LOE 2014 compared to LOE 2005 is a similar. One Member LLC is an enterprise owned by one organization or individual (“Company Owner”), the Company Owner is liable for all debts and other property obligations of the company to the extent of the amount of the charter capital of the company.

1.1. Rights of the Company Owner

Under LOE 2014, the Company Owner has the following typical rights[1]:

-

To make decisions on the company’s charter, on developmental strategies and annual business plans, on projects for investment and development;

-

To make decisions on the organizational and managerial structure of the company, and to appoint the company’s managers;

-

To make decisions on increase in charter capital; on assignment of all or part of the charter capital;

-

To make decisions on use of profit after fulfilment of tax obligations and other financial obligations of the company; on re-organization or dissolution and petition for bankruptcy of the company.

In addition, the Company Owner being an organization has other rights as follows:

-

To approve loan agreements and other contracts as stipulated in the company’s charter valued at fifty (50) or more per cent of the total value of the company’s assets[2];

-

To make decisions on sale of assets valued at fifty (50) or more per cent of the total value of the company’s assets[3].

We are especially noted that if the Clients do not want to perform directly the rights mentioned above, the Clients must authorize the chairman implement them via a Power of Attorney.

1.2. Obligations of the Company Owner

Under LOE 2014[4], Besides the basic obligation of the Company Owner such as: to contribute the charter capital; to comply with the charter and laws; to identify and separate assets of the Company Owner from assets of the company. We are especially noted that Company Owner may withdraw capital only by way of assignment of a part or all of the charter capital to other organizations and individuals; in the case of withdrawal of all or part of its contributed charter capital from the company in another form, the Company Owner and the organization or individual concerned must be jointly liable for debts and other property obligations of the company.

Furthermore, the Company Owner may not withdraw profit in cases where the company has not paid in full all debts and other property obligations which are due.

1. Organizational and managerial structure of One Member LLC

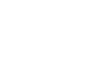

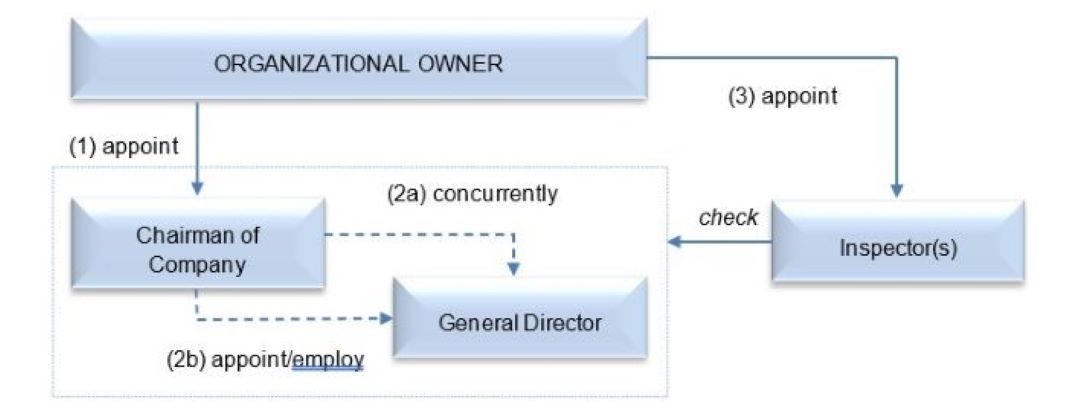

1.1. Managerial structure of One Member LLC owned by an organization

Under LOE 2014[5], One Member LLC owned by an organization shall be organized, managed and operate in either of the following models:

a. Chairman, General Director and Inspector(s)

b. Members’ Council, General Director and Inspector(s)

2.2. Management structure of One Member LLC owned by an individual

Under Law on Enterprise 2014[6], One Member LLC owned by an individual shall have a Chairman and a General Director. The Chairman may act concurrently or employ another person as the General Director.

3. Contracts and transactions of One Member LLC with the related persons

Under LOE 2014[7], any contract or transaction between One Member LLC owned by an organization and the following persons must be considered and decided by the Members’ Council or Chairman, Director/General Director and Inspector(s):

- Company Owner and Related Person[8] of Company Owner;

- A member of Members’ Council, Director/General Director and Inspectors;

- Related Person of the persons stipulated in point (ii) mentioned above;

- A manager of Company Owner, the person authorized to appoint such managers;

- A related person of the persons stipulated in sub-clause (d) of this clause.

We are especially noted that:

- The signatory of the contract must notify Members’ Council or Chairman, Director/General Director and Inspectors of entities involved in such contract or transaction; and concurrently enclose the draft of such contract or main contents of such transaction.

- A contract or transaction shall be void and dealt with in accordance with law where it is not entered into in accordance with the relevant provisions, causing loss and damage to the company. The signatories to the contract and related persons being the parties to the contract must be jointly responsible for any loss arising and for returning to the company any benefit gained from the performance of such contract or transaction.

- A contract or transaction between One Member LLC owned by an individual and Company Owner or Related Person of Company Owner must be recorded and retained as a separate file of the company.

________________________________________________

[1] Article 75 of LOE 2014

[2] Or a smaller percentage or value as stipulated in the company’s charter

[3] Or a smaller percentage or value as stipulated in the company’s charter

[4] Article 76 of LOE 2014

[5] Article 78, 79, 80, 81 and 82 of LOE 2014

[6] Article 85 of LOE 2014

[7] Article 86 of LOE 2014

[8] Related Person is defined in Clause 18 Article 4 of LOE 2014

________________________________________________

@ Copyright 2015 – Công ty Luật QNT